Adjusting entries help a company accurately measure its financial performance and position. They are essential for ensuring that financial statements reflect the true economic reality of a business. This article will explore the purpose, types, methods, and impact of adjusting entries, providing a comprehensive understanding of their importance in financial reporting.

Adjusting entries are crucial for maintaining the integrity and reliability of financial statements. They allow companies to recognize revenues and expenses in the correct periods, ensuring that financial results are presented fairly and accurately.

Understanding Adjusting Entries

Adjusting entries are accounting transactions made at the end of an accounting period to ensure that financial statements accurately reflect the company’s financial position and performance.

They are crucial for correcting the effects of transactions that have not yet been recorded or for adjusting recorded transactions to reflect their true economic substance.

Types of Adjusting Entries, Adjusting entries help a company accurately measure

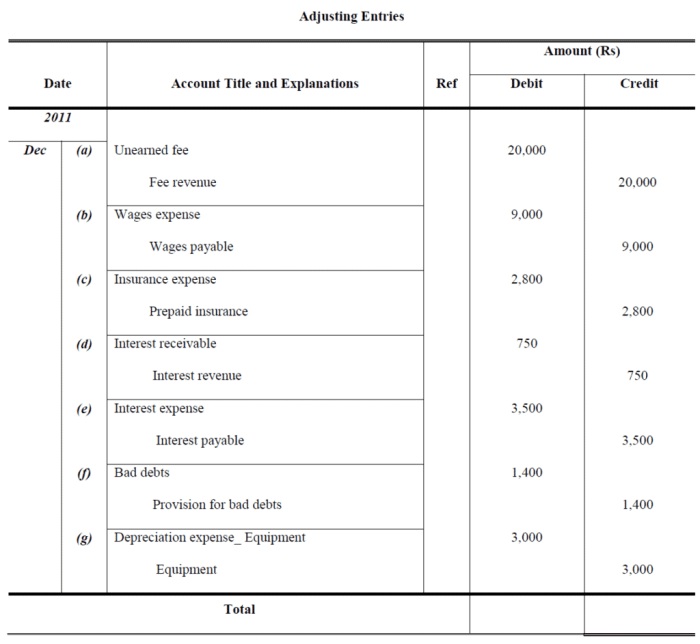

- Accruals:Record revenues earned but not yet billed or expenses incurred but not yet paid.

- Deferrals:Record revenues received in advance or expenses paid in advance.

- Depreciation:Allocate the cost of fixed assets over their useful lives.

- Amortization:Allocate the cost of intangible assets over their useful lives.

Methods for Recording Adjusting Entries

Adjusting entries can be recorded using T-accounts or journal entries.

T-Accounts:Separate accounts are created for each asset, liability, equity, revenue, and expense. Adjusting entries are recorded by increasing or decreasing the balance of the appropriate account.

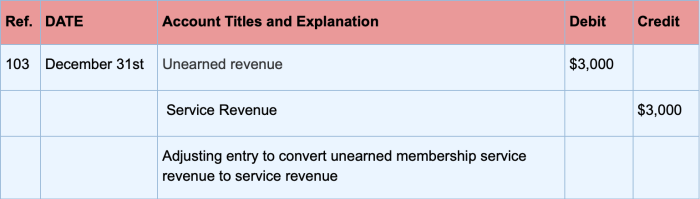

Journal Entries:A journal entry is a single transaction recorded in the journal. Adjusting entries are recorded by debiting one account and crediting another account.

Impact of Adjusting Entries on Financial Statements

Adjusting entries affect the income statement, balance sheet, and statement of cash flows.

Income Statement:Accruals increase revenues and expenses, while deferrals decrease revenues and expenses.

Balance Sheet:Accruals increase assets and liabilities, while deferrals decrease assets and liabilities. Depreciation and amortization decrease assets.

Statement of Cash Flows:Adjusting entries do not directly affect cash flows.

Best Practices for Adjusting Entries

- Establish a systematic approach for identifying and recording adjusting entries.

- Ensure timely and accurate adjustments to maintain the integrity of financial statements.

- Document the rationale for each adjusting entry to ensure transparency and auditability.

Answers to Common Questions: Adjusting Entries Help A Company Accurately Measure

What is the purpose of adjusting entries?

Adjusting entries are used to record transactions that have occurred but have not yet been reflected in the accounting records. They ensure that financial statements accurately represent the financial position and performance of a company.

What are the different types of adjusting entries?

Common types of adjusting entries include accruals, deferrals, and depreciation. Accruals recognize revenues earned but not yet received and expenses incurred but not yet paid. Deferrals recognize expenses paid in advance and revenues received in advance. Depreciation allocates the cost of long-lived assets over their useful lives.

How are adjusting entries recorded?

Adjusting entries can be recorded using T-accounts or journal entries. T-accounts provide a visual representation of the changes to specific accounts, while journal entries provide a chronological record of transactions.

What is the impact of adjusting entries on financial statements?

Adjusting entries affect the income statement, balance sheet, and statement of cash flows. They ensure that revenues and expenses are recognized in the correct periods, resulting in a more accurate representation of financial performance and position.